Poverty in America | Change.org

by Leigh Graham

Feministe has a must-read post about Rachel Porcaro, a single mother of two in Seattle, who was audited by the IRS for being too poor. Seriously. In a nutshell, because her reported income was so low relative to Seattle residents, the IRS thought she was lying. The IRS, triggering enormous financial bills for the family, extensively investigated both her and her parents, with whom she and her children live. The IRS ultimately refused to recognize the children as her dependents, because her paltry wages and residence in her parents' home indicated to them that Ms. Porcaro was incapable of providing for her kids and thus couldn't claim them as her dependents. Effectively, her children no longer exist.

This is an atrocious story and indicative of the hassle we give low-income Americans simply for their impoverished existence, which only further consigns them to economic hardship. Too poor to get credit? Too poor to live near a bank? Too poor to qualify for taxes? It'll cost you.

The poor routinely pay more to access services many of us enjoy for free: usurious payments to cash checks at Western Union because they are unbanked; hefty interest rates on payday loans or “refund anticipation loans” prior to Tax Day; even higher prices for groceries because large and reasonably priced supermarkets are out of reach without a car or easily accessed public transportation. Our tax structures also can cost the poor more: a study released last month revealed that Alabama’s working poor have the highest tax rate in the country.

Back to Mrs. Porcaro and her imaginary children. Under GOP rule, the IRS had audited Earned Income Tax Credit recipients twice as often as the general public. Republicans have labeled the EITC "backdoor welfare" and tried to eliminate it, resorting to nasty - and costly - investigations of taxpayers in retaliation for their living high off the hog. IRS audits of the poor have been rising in the last two decades, while audits of the wealthiest Americans have fallen.

President Obama received praise for expanding the EITC as part of the stimulus package, though it still doesn’t reach nearly all the working poor who could benefit. Turns out, a necessary ingredient in making the EITC work for eligible Americans includes stopping these punitive, classist and unfair audits.

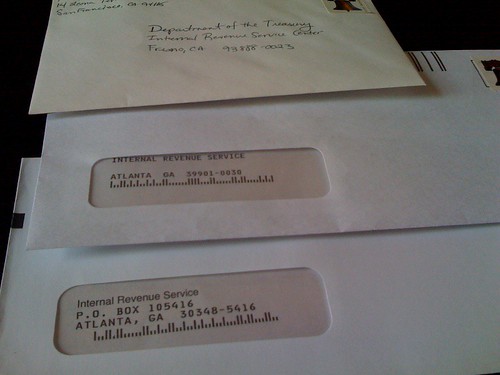

(Photo by NatalieHG)

No comments:

Post a Comment